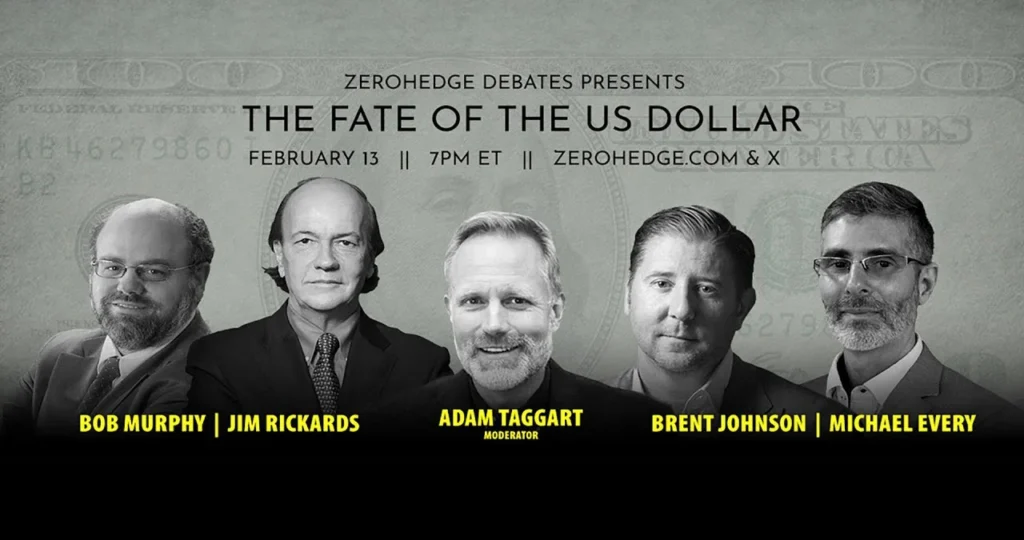

ZeroHedge: The Controversial Finance Blog Shaking Wall Street

Introduction: The Enigma of ZeroHedge

In the high-stakes world of financial media, few names spark as much debate as ZeroHedge. Known for its unfiltered market analysis, doom-and-gloom predictions, and anti-establishment tone, this finance blog has become a go-to source for traders, conspiracy theorists, and skeptics of mainstream financial narratives.

But what makes Zero Hedge so controversial? Why has it been banned from social media platforms, yet still commands a loyal following of millions? And should investors trust its often-dire warnings?

This deep dive explores:

✔ Zero Hedge’s origins and anonymous founders

✔ Its most infamous market predictions

✔ Why Wall Street and governments distrust it

✔ The accusations of misinformation and conspiracy theories

✔ How traders use (or ignore) its insights

What Is ZeroHedge?

Launched in 2009 during the aftermath of the global financial crisis, ZeroHedge (often stylized as “ZH”) brands itself as “on a long-term macro crusade against government and central bank policy.”

Key Features of ZeroHedge:

- Anonymous authorship (most articles credited to “Tyler Durden,” a Fight Club reference)

- Bearish, contrarian takes on markets, economics, and geopolitics

- Aggressive criticism of the Federal Reserve, big banks, and policymakers

- Real-time financial data and unconventional charts

- A mix of financial analysis, conspiracy theories, and fringe viewpoints

Unlike Bloomberg or CNBC, Zero Hedge thrives on skepticism of official narratives, making it both respected and reviled in financial circles.

Why ZeroHedge Is So Controversial

1. The Mystery of “Tyler Durden” – Who Runs Zero Hedge?

For years, the site’s true ownership was unknown until 2016, when Bloomberg revealed that Daniel Ivandjiiski, a former hedge fund analyst (once banned from the industry for insider trading), was behind it.

This fueled criticism that Zero Hedge:

✔ Lacks transparency in its reporting

✔ May have conflicts of interest (some speculate it’s used to manipulate markets)

2. Censorship Battles: Why Big Tech Banned ZeroHedge

In 2020, Zero Hedge was temporarily banned from Twitter and demonetized by Google after accusations of spreading COVID-19 misinformation.

Critics argue:

- It amplifies conspiracy theories (e.g., pandemic origins, election fraud)

- Its sensationalist headlines often lack credible sourcing

Yet, supporters claim:

- It’s a victim of Silicon Valley censorship

- Mainstream media ignores real risks that Zero Hedge highlights

3. ZeroHedge’s Most Shocking Predictions – Right or Wrong?

Predictions That Came True:

✅ 2008 Housing Collapse (early warnings on subprime mortgages)

✅ 2020 Market Crash (predicted COVID-19’s economic impact before most)

✅ Inflation Surge (warned about Fed money-printing consequences years in advance)

Predictions That Flopped:

❌ Hyperinflation by 2012 (never happened)

❌ “The End of the Dollar” (still the global reserve currency)

❌ Multiple “Market Crash” Warnings (some were false alarms)

How Wall Street Uses (or Ignores) Zero Hedge

Who Reads ZeroHedge?

- Hedge fund traders (looking for contrarian signals)

- Retail investors (drawn to its anti-establishment vibe)

- Preppers & gold bugs (who believe in economic collapse)

- Conspiracy theorists (attracted to its alternative narratives)

Should Investors Trust It?

✔ Pros:

- Often spots risks before mainstream media

- Provides raw data and charts useful for analysis

- Challenges groupthink in financial markets

❌ Cons:

- Tends toward sensationalism

- Mixes facts with unverified claims

- Has a strong ideological bias

Expert Take:

“ZeroHedge is like a financial smoke alarm—sometimes it’s a false alarm, but when it’s right, it’s right. Always verify its claims with other sources.” – Market strategist (anonymous)

The Future of ZeroHedge: Will It Survive?

Despite bans and backlash, Zero Hedge still attracts 10M+ monthly visitors. Its future depends on:

🔹 Adapting to censorship (moving to alternative platforms like Telegram)

🔹 Balancing doom-mongering with credible reporting

🔹 Whether regulators take action against it

Conclusion: ZeroHedge – Financial Oracle or Fearmonger?

ZeroHedge remains one of the most polarizing voices in finance. While it has accurately predicted major crises, its penchant for conspiracy theories and hyperbole makes it a risky sole source for investors.

For traders: Use it as a contrarian indicator, but always cross-check data.

For casual readers: Be wary of alarmist headlines and verify claims.

Love it or hate it, ZeroHedge isn’t disappearing—and as long as markets remain volatile, its warnings will keep shaking Wall Street.

- Is ZeroHedge a reliable source for financial news?

- While ZeroHedge has accurately predicted several major market events, its controversial reputation stems from mixing verified data with unverified claims. Financial experts recommend using it as a contrarian indicator rather than a sole source, always cross-referencing its analysis with mainstream financial outlets.

- Why was ZeroHedge banned from social media platforms?

- ZeroHedge faced temporary bans from Twitter and Google Ads in 2020 for allegedly spreading COVID-19 misinformation. The bans reflect ongoing tensions between alternative financial media and tech platforms’ content moderation policies, with critics arguing it’s censorship while supporters claim it’s necessary fact-checking.

- Who writes for ZeroHedge?

- Most articles are published under the pseudonym “Tyler Durden,” a reference to Fight Club. Investigations revealed former hedge fund analyst Daniel Ivandjiiski as a key figure behind the platform. The anonymous nature of its contributors remains a point of controversy regarding accountability.

- What kind of investors follow ZeroHedge?

- The platform attracts three main groups: 1) Hedge fund traders seeking alternative market perspectives, 2) Retail investors drawn to its anti-establishment stance, and 3) “Doomberg” investors preparing for economic collapse. Its audience tends to be more risk-aware and skeptical of official narratives.

- Has ZeroHedge ever been right about major market moves?

- Yes, ZeroHedge has notable correct calls including the 2008 housing crash, the 2020 pandemic market crash, and the recent inflation surge. However, it also has a history of premature crash predictions (like repeated “dollar collapse” warnings) that didn’t materialize, leading critics to accuse it of fearmongering.